Page 1 of 1

financial earnings v economic earnings

Posted: Wed Mar 15, 2023 1:13 pm

by aja57

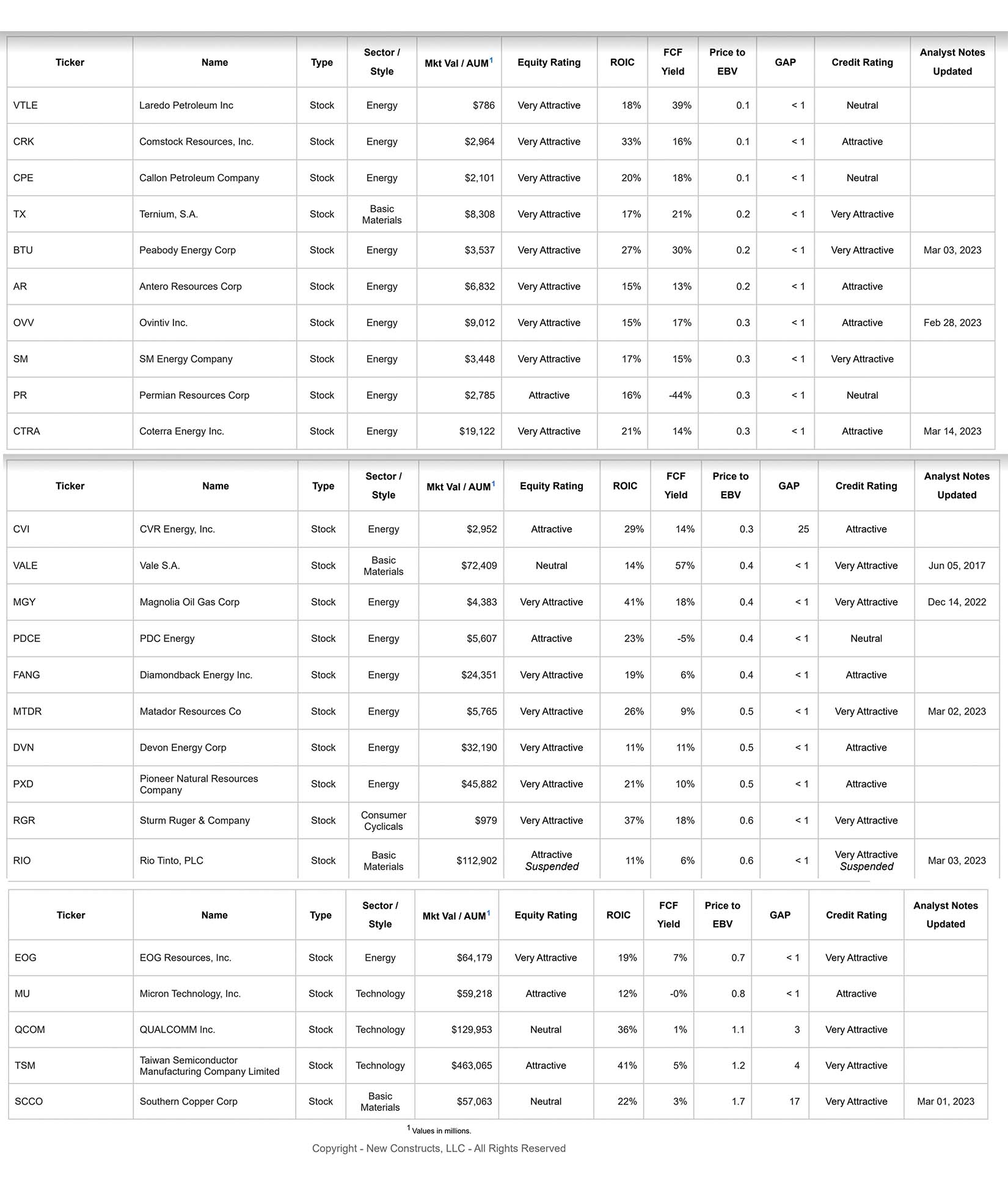

I don't whether any of you follow David Trainer, the founder of New Constructs. Trainer believes in forensic accounting in order to determine economic rather than financial earnings. While Wall Street typically evaluates stocks using formulations more built for bonds, Trainer takes the accounting info and looks at indicators that are more geared toward equity. Trainer looks at NOPAT(net operating profit after taxes) ROIC(return on invested capital),free cash flow yield, price to economic book value and implied growth appreciation period. I would encourage anyone with value investing in mind to go to New Constructs.com to understand his methodology. Suffice to say, the reason I'm posting this topic is that with the craziness in the oil/natural gas sector as of today, I wanted to convey to the members that while Dan uses a different methodology for stock evaluation, the stocks Dan recognizes as the best investments are reaffirmed in Trainer's database through his methodology. Below is a pdf of most of Dan's portfolio. Small market cap stocks like SBOW are not followed by Trainer. Nor are MLPs and many Canadian companies. There are a few other stocks I follow that are immaterial to oil and natural gas.

- NewConstructs_031523 (002).jpg (244.26 KiB) Viewed 233 times

The bottom line: These market downtrodden companies have substantial FCF yields, ROIC and are underpriced by the market in some instances as much as 10 fold. As a former surgeon mentor once said to me, all things in healing need elixir of patience and tincture of time.

Re: financial earnings v economic earnings

Posted: Wed Mar 15, 2023 3:47 pm

by dan_s

Great post. Thanks.

I have been an accountant in the oil & gas industry for over 40 years. SEC/GAAP accounting rules for upstream oil and gas companies can be extremely misleading. That is why I focus on operating cash flow. Companies that are able to grow production and proved reserves funded completely with operating cash flow (no need for debt or equity offerings) are extremely attractive to me.

Re: financial earnings v economic earnings

Posted: Wed Mar 15, 2023 5:01 pm

by Fraser921

I favor free cash flow yield to enterprise value.

Some companies may have positive operating cash flow but negative "free cash flow"

A company that isn't making cash after all expenses has no economic value to me. If you want to bet on improved pricing , fine, but it's a bet.

Shale E&P's have to spend a ton of cash just to maintain production as the production depletes at a very high rate For instance;

CRK goal is to break even this year based on their last earnings call. That's when NG prices were higher than they are today

From their call "So our goal is net net-net, to get quarter-by-quarter-by-quarter, if you get through 2023, and it's a soft year, our goal is to not have borrowed net at the end of next year, $0.01 from our credit facility"

Note : not to borrow, in essence break even. He didnt say grow cash, reduce debt

So I asked the question before. "how much are you willing to pay for a company that isn't generating cash"

You can assume NG will be higher in 2024 and that will create cash but you are betting on improved prices not the current situation. Now its spilled over to oil companies

And do you think the banks will be there to lend if they need money? Some banks were already blackballing energy companies. They are going to stop lending, period and shore up their own balance sheets.

I predict the Fed stops raising rates next week.